This year’s conference focused on the needs of the global energy transition and the role the Western (non-China) rare earth industry will play in decarbonization. The transition moves us along the path to electric vehicles and wind energy where permanent rare earth magnets are essential to these technologies.

The rare earths industry, like other critical material supply chains (lithium, cobalt, etc.), face overwhelming demand (and need for action) according to energy transition timelines (with 2030 and 2050 horizons) – which leaves us “ore-guys” scrambling to find, fund and develop resources to reduce our dependence on foreign critical mineral supply.

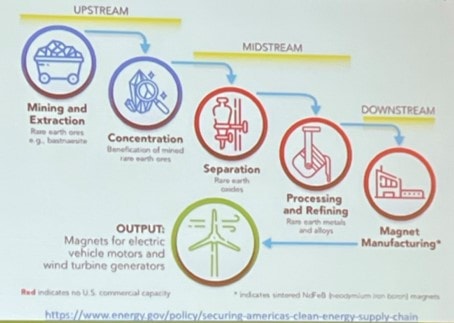

The Department of Defense has declared its intention – starting January 1, 2026 – to no longer purchase rare earth materials (magnets) – critical to defense – from supply chains including North Korea, China, Russia, and Iran. The prohibitions require transparency in the supply chain, starting with raw materials, through processing, separations, metal making and magnet manufacturing – to deliver products totally independent of China’s rare earth product monopoly.

While this is a bold and necessary move by the DoD, what about industries that rely on the current supply chain for myriad rare earth products?

Those that can, like General Motors, chose to invest in magnet manufacturing by partnering with VACUUMSCHMELZE to bring magnet making technology to the USA for rare earth permanent magnets for GM’s EV motors. This step towards supply security, will achieve transparency from “mine to showroom” for component supply. What about those that don’t have the means (or desire) to contract their own security of supply? Therein lies the opportunity (and challenge) for us in the rare earth industry.

On the raw material supply side, NioCorp Developments Ltd.’s Elk Creek (Nebraska) critical mineral deposit intends to produce Neodymium (Nd) and Praseodymium (Pr) Oxide, Dysprosium (Dy) Oxide, Terbium (Tb) Oxide, Scandium (Sc) Oxide, Ferroniobium (Nb), (and titanium (Ti) via chlorination). Aclara Resources promoted their Dy, Tb opportunity from their ionic clay project in southern Chile. Australian Rare Earths discussed their Koppamurra ionic clay project. Rainbow Rare Earths is targeting recovery of NdPr, Dy, and Tb from phosphate mine waste (gypsum stacks) in South Africa, and have a memorandum of understanding with The Mosaic Company in Brazil. Métaux Torngat Metals Ltd. promoted their (remote) Strange Lake rare earth project. Defense Metals Corporation promoted their Wicheeda project, with a complex mix of parasite, bastnaesite and monazite.

Follow Alpha GeoLogic, LLC as I dive deeper into each of the 15 presentations from last week’s conference, and keep you abreast of the developments as I work to develop a practical, domestic monazite supply chain!